Business Insurance in and around London

One of the top small business insurance companies in London, and beyond.

This small business insurance is not risky

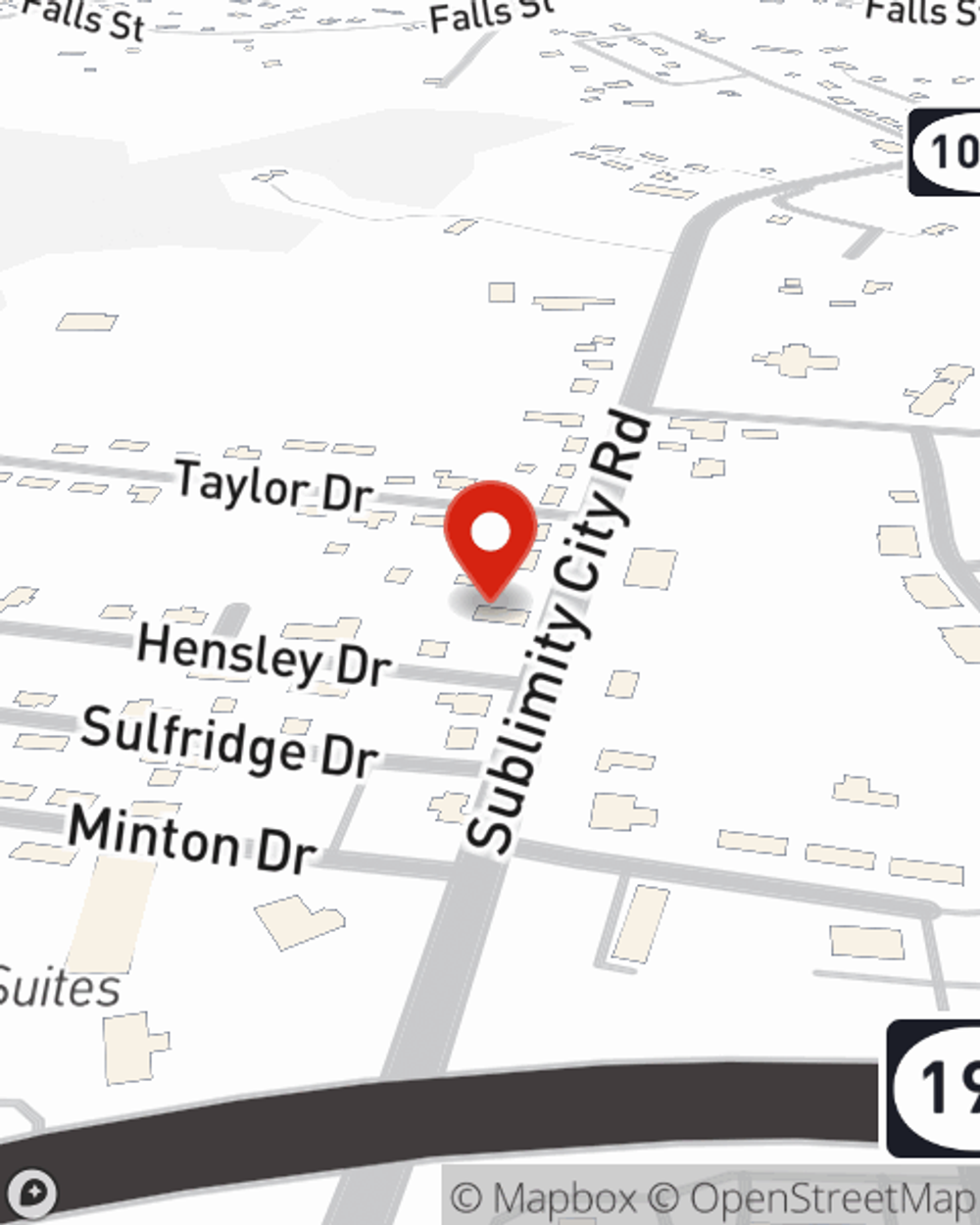

- jackson County

- laurel county

- knox county

- Whitley County

- London KY

- Keavy KY

- McKee KY

- Annville KY

- E Bernstadt KY

- Tyner KY

- Livingston KY

- Corbin KY

- Lily KY

- Green Mount KY

- Kirkwood

- North Laurel

- South Laurel

- Sublimity

- Victory, KY

- Manchester, KY

- Leslie county

- Perry County

- Harlan County

- Bell county

Business Insurance At A Great Price!

Whether you own a a lawn care service, a flower shop, or an antique store, State Farm has small business insurance that can help. That way, amid all the different decisions and options, you can focus on making this adventure a success.

One of the top small business insurance companies in London, and beyond.

This small business insurance is not risky

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, business owners policies or surety and fidelity bonds.

As a small business owner as well, agent Phil McDonald understands that there is a lot on your plate. Visit Phil McDonald today to discover your options.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Phil McDonald

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.